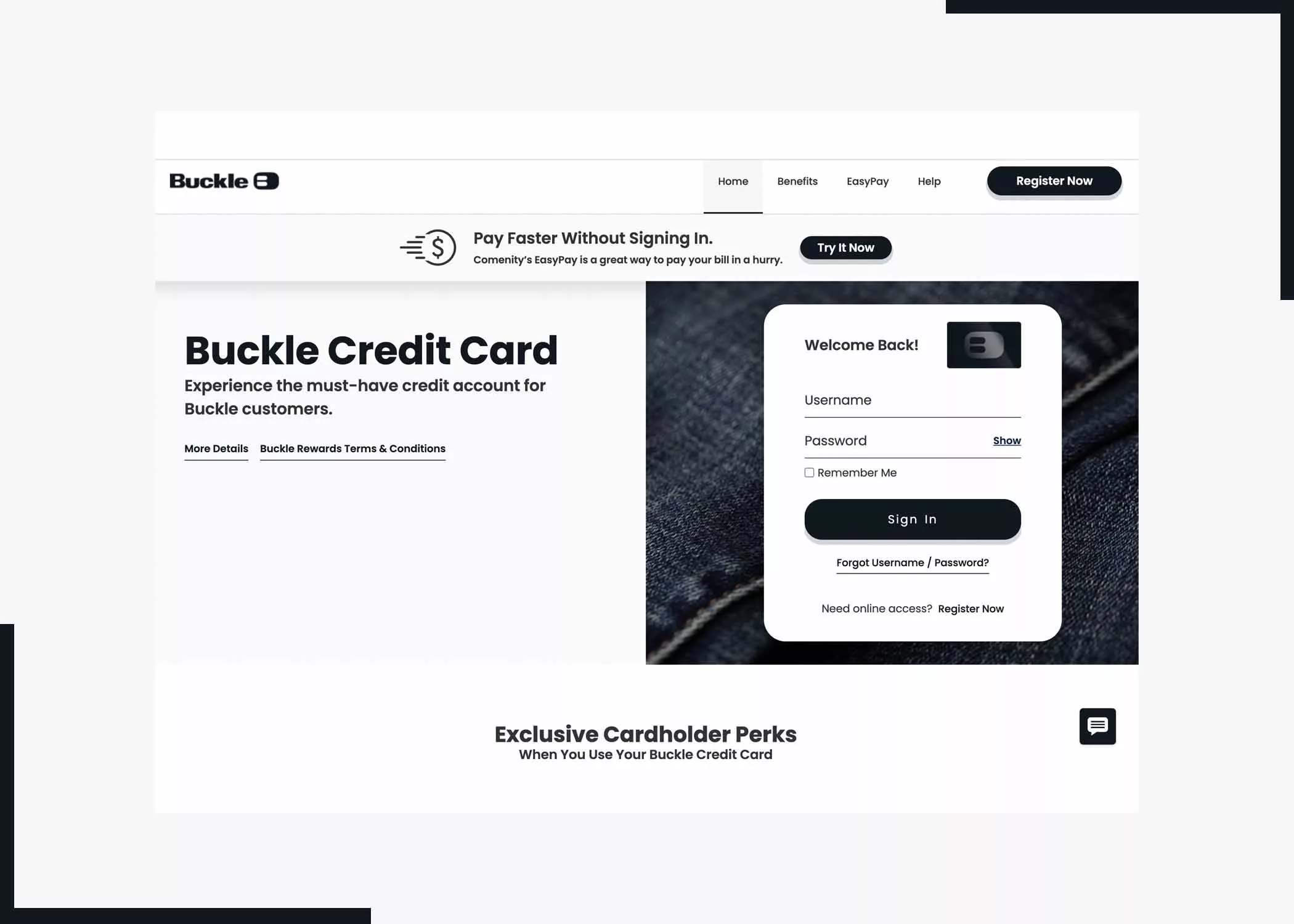

A Citi Diamond Preferred card comes with all the benefits of a Citi credit card, including a payment due date of your choice, reliable customer service, and $0 liability for unauthorized charges. You can access your Citi Diamond Preferred card online.

Do you have a Citi Diamond Preferred Card? If not, you’re missing out! But don’t worry, I’m here to give you all the information you need to know about this card. Keep reading to learn more.

If you know you will need a long time to pay down an existing balance, the card is the best option for you. It offers one of the longest 0% intro APR periods on balance transfers available. But if you’re chronically forgetful, the Citi Diamond preferred card online is a better choice. Then that is the right card for you to use.

Citi Diamond Preferred Card

Talking about this amazing Citi Diamond Preferred Card, the Citi Diamond Preferred card offers a lengthy 0% intro APR on balance transfers and purchases for an interest-free period of more than a year. For the right applicant, this super long window could make it a worthy get-out-of-debt card.

The card doesn’t earn rewards, however, so there’s little incentive to use it once you’ve paid off your balance. You can learn how to apply for your card online and also how to activate your card online.

Citi Diamond Preferred Card Rewards

To be frank, the Citi Diamond Preferred Card does not offer rewards or a sign-up bonus. But it is definitely worth having because of Its long interest-free period for purchases and balance transfers. It offers 0% Intro APR for 21 months on Balance Transfers and 12 months on Purchases, and then the ongoing APR of 15.24%-25.24% Variable APR. That can help you finance a large purchase or get out of debt.

Citi Diamond Preferred Card Benefits

Below are some of the benefits of the Citi Diamond Preferred Card Online:

- Citi identity theft solutions.

- Zero liability fraud protection.

- Citi Concierge services.

- 24 customer service.

- Virtual account numbers for shopping online or by mail.

- EMV chip technology.

- Automatic account alerts.

- You will have access to the FICO score every month.

Those are some of the benefits of Citi Diamond Preferred Card Online you need to know about.

New Citi Diamond Preferred Card Application

The Citi Diamond Preferred Card complete application comes when you meet up with the need requirements of the Citi website. Those who wish to apply for the credit card should have to meet these requirements:

- You should be 18 years old and above.

- Have a valid SSN/ITIN.

- Lastly, be a resident of the United States of America.

When the above are in place, you can then go ahead and apply for a credit card on their website.

If you have decided to use the Citi Diamond Preferred Card, then you have to get one, and before you can get one, you will have to apply for it online. In this part of the article, you will be able to do that; you just need to follow some steps. You can also apply by phone through the number calling the customer service number.

How to Apply for a Citi Diamond Preferred Card

Have you tried to apply for the Citi Diamond Preferred Card before? Did you find the application difficult? You will be able to apply for the card if you follow the steps below:

- You should visit their official web page www.citi.com/credit-cards/citi-diamond-preferred-credit-card

- Once the page shows, you will see the “Apply Now” on the right-hand side click on it.

- On the next page, you will have to enter some personal information which includes first name, middle initial, last name, suffix (opt), home address, social security number, date of birth (MM-DD-YYYT), country of citizenship, mobile phone number, and email address.

- Fill in your security word and financial information, and then you can click on “Agree & Submit” to complete your application.

In case you don’t know, you have to check all the boxes before you submit the application. That is all you have to do in order to get your Citi Diamond Preferred Card.

New Citi Diamond Preferred Card Activation

If you have received your Citi Diamond Preferred Card, it is very important you activate the card before you use it. This is because it may not work, and the function of your card rests wholly on the card activation. There are various ways you can use to activate your card. You can activate the card via phone call or online through their website.

You will be able to learn how to activate the card through their online website and via phone; either way, the information will be provided.

How to Activate Citi Diamond Preferred Card Online

Activating your card online is one of the easiest ways for Citi Diamond Preferred Card activation. Here are simple steps to consider when you want to activate your card:

- Visit www.citi.com

- On the page that loads up, you will see register/activate. Click on “Activate” below the sign-on.

- You will be asked to enter your Card Number

- Then click on “Continue.”

After that, you can follow the onscreen process to activate your card. Which is very easy.

How to Activate Citi Diamond Preferred Card Via Phone

Here are simple steps to consider when you want to activate your card via phone call:

- When having challenges activating your card, you will have to visit the Citi official website at www.citi.com

- Scroll down the website.

- To access their customer centre.

Use the contact below the customer support option to reach customer service for help on your card activation.

Citi Diamond Preferred Card New Account Registration

If you do not have an online banking account for your card yet, you will have to register for an online card account so that you will be able to manage your card online. The Citi Diamond preferred card online access account registration is fast and simple.

How to Register for Citi Diamond Preferred Card Access

To register for online access, follow the information below:

- Go to your web browser and search for online.citi.com

- You will be asked to enter your credit/debit card number, bank account number, and paycheck protection program loan account number.

- After that, you can now click on “continue set up.”

Then, follow the onscreen directives to complete the registration process.

Citi Diamond Preferred Card Log in

Having known how to sign up for an account and have gotten an account, it is very easy for cardholders to access their account online. If you have a Citi Diamond preferred card online, you are eligible to access it online. The Citi Diamond preferred card online login process is fast and simple Log in Now!

How to log into the Citi Diamond Preferred Card Account:

If you were finding it hard to access your account online, use the steps below to log in to your account:

- Go to their official website www.citi.com

- You will have to enter your user ID and Password.

- Then, you can click on “sign on.”

These are the steps you need to follow for the Citi Custom Cash Card login.

Forgot Citi Diamond Preferred Card User ID

For you to recover your User ID, you need to provide certain details. Check out the steps below for guidance:

- Type In https://online.citi.com/US/ag/forgot-userid-pwd/account-type?fuipFlowInd=userID.

- Enter your ATM/Debit or Credit Card Number correctly in the text form.

- Then, hit on the “Continue” button.

Continue with the instructions on your screen to recover your User ID.

Forgot Citi Diamond Preferred Card User ID Password

Check out the steps below to reset your Password:

- Go to your web browser and search for https://online.citi.com/US/ag/forgot-userid-pwd/account-type?fuipFlowInd=pwd.

- Fill out the text form with your ATM/Debit or Credit Card Number.

- Click on the “Continue” button.

You will need to follow the directives in the next section to reset your password and access your account again.

Frequently Asked Questions

How do you transfer a balance to a Citi Diamond Preferred Card?

You can start by calling the customer service number on the back of the card. Another option is to request a transfer with your application, but it takes at least 14 days after opening an account to complete the process.

The total amount transferred must be less than your available credit limit on the Citi Diamond Preferred Card, and you can’t transfer debt from another Citi card.

Once the transfer is approved, Citi pays the amount requested to the issuer of the other card, and that same amount is charged to your Citi Diamond Preferred Card.

Is it Hard to Qualify for the Citi Diamond Preferred Card?

You’ll need excellent credit — typically defined as a FICO score of 720 or higher — to qualify for the Citi Diamond Preferred Card. Issuers also take into account factors like your income and your debt obligations.

What is the Difference Between the Citi Simplicity and the Citi Diamond Preferred Card?

The Citi Simplicity Card and the Citi Diamond Preferred Card have comparable 0% introductory periods, balance-transfer fees, and ongoing APRs, and both have a $0 annual fee.

When you compare the two, they have one key difference: The Citi Simplicity Card doesn’t charge a fee or impose an APR penalty for late payment. That’s not the case with the Citi Diamond Preferred® Card.

How do I Pay for my Citi Diamond Preferred Card Online?

Below are the steps that will bring to your notice how I can pay for my Citi Diamond preferred Card Online:

- Online: you will need to log in to your online account and tap on “Make a Payment.”

- Through Mobile app: you can download the app for Android or iOS.

- Over the phone: you can call their customer service for guidance or the number on the back of your card and enter the card information when prompted.

Is it Possible to View my Citi Card Online?

You will need to log on to your Citi Mobile App. Hit on Account Summary on the Home Screen. Click on the Required account for statement, for example, your saving account. You can then be able to view you’re your debit and credit transactions as you scroll.

How do I Log into my Citi Diamond Preferred Card?

To log in to your Citi Diamond Preferred Card account, go to the login page on the Citibank website or mobile and input your username and password in the appropriate fields. Click on the “Sign On” button to access your online account.

Is the Citi Diamond Preferred Card a Metal Card?

Want to know if the Citi Diamond Preferred card is a Metal Card? The only Citi Metal credit card is the Citi AAdvantage Executive World Elite Mastercard.

Is the Citi Diamond Preferred Card Hard to Get?

The answer is yes. The Citi Diamond Preferred card is hard to get, as it needs good to excellent credit. You need to have a credit score of 700 or even better.

Does the Citi® Diamond Preferred® card earn rewards?

The Citi® Diamond Preferred® card does not earn rewards.

Will a balance transfer impact my credit score?

A balance transfer to the Citi® Diamond Preferred® Card can benefit your credit score if you pay down your debt, lowering your overall debt utilization ratio.

Also, Check Out: