Skrill Money Transfer: Skrill is a worldwide system for sending money and making payments. It’s not just for shopping but also for trading and playing games. Skrill helps you take care of your money. With Skrill Money Transfer, you can quickly send money to your own account or someone else’s bank account, credit/debit card, or mobile wallet. It’s safe, fast, and secure when you use it on the internet.

Making payments or sending money to other countries is easy with your Skrill wallet. When you use Skrill, you get to enjoy low rates and fees for sending money. You can transfer money straight to a bank account, your Skrill wallet, or a mobile wallet. This gives you flexibility and convenience.

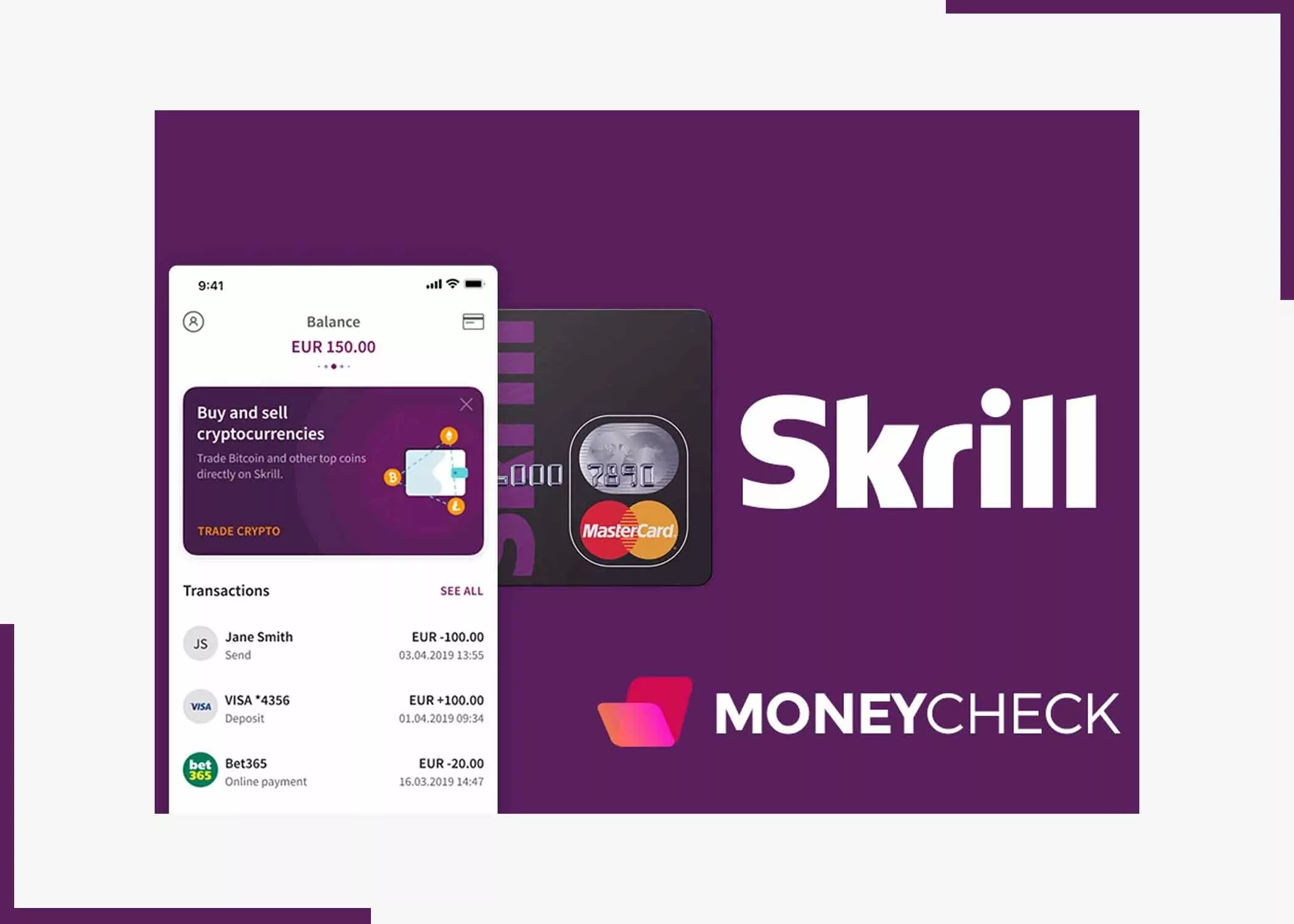

As earlier mentioned, Skrill helps you move money from your bank to a mobile wallet. Skrill customers can also get a special prepaid card linked to their account, and it can use different currencies like USD, EUR, PLN, and GBP.

If you use Skrill a lot, and you’re a special customer with a lot of numbers, you might get something called “Skrill VIP.” This comes with extra things like a security token, a multi-currency account, and the chance to earn points for being a loyal customer.

Features of Skrill Money Transfer

Skrill Money Transfer has many cool things you should know about. Here are some features;

- You can transfer money on Skrill without paying any fees.

- Sending money directly to a bank account using Skrill won’t cost you any transfer fees. You can use a calculator to see how much money you save.

- You can deposit cash using Visa and MasterCard, and this is available in all countries.

- There are no fees when you use Skrill to send money to an international bank account.

- You can quickly buy and sell cryptocurrency using Skrill, with options like Bitcoin, Bitcoin Cash, Ether, and more.

- Sending and receiving money is easy on Skrill. You can link cards and bank accounts, and it’s safe to pay with just your email and password.

- Skrill takes security seriously. Your payment and personal info are always kept safe, and there’s a team working to stop fraud in any transaction.

- If you have a Skrill wallet, you can send and get money instantly with just an email address, and the fees are only 1.45%.

- Skrill users get special offers. You can easily access the latest deals, offers, and bonuses from different merchants every month.

- You can get to your money whenever you want, 24/7.

- You can use the Skrill app to access your account safely from anywhere you need it.

How Does Skrill?

Skrill operates as a versatile online payment platform, offering users a comprehensive range of features to manage their finances securely. Here’s a detailed look at how Skrill works:

Sign Up

To begin your journey with Skrill, you need to sign up for an account either on their website or through the user-friendly mobile app. During this process, you provide essential personal information, creating a secure and personalized account.

Verification

Skrill places a strong emphasis on security and compliance. As part of the onboarding process, users are required to undergo identity verification. This step ensures the integrity of the platform and adherence to regulatory standards.

Add Funds

With your account successfully set up, you can fund your Skrill wallet. This can be achieved through various means, including linking your bank account, utilizing credit/debit cards, or exploring other available funding methods.

Send Money

One of the core functionalities of Skrill is its ability to facilitate secure and efficient money transfers. Users can initiate transfers by selecting recipients and specifying the desired transfer amount. This feature extends to both Skrill users and individuals identified by their email addresses.

Receive Money

If you are on the receiving end, funds sent to you through Skrill will be deposited into your Skrill account. From there, you have the flexibility to either withdraw the funds to your linked bank account or leverage them for online transactions.

Online Payments

Skrill serves as a widely accepted payment method at numerous online merchants. Users can seamlessly integrate Skrill into their online transactions by selecting it as a payment option during checkout. Logging into their Skrill account completes the payment process.

International Transfers

Skrill’s global reach enables users to conduct international money transfers efficiently. This feature is particularly advantageous for individuals needing to send money across borders, making the platform a preferred choice for both domestic and international transactions.

Security Measures

Skrill prioritizes the security of its users. Advanced encryption technology, two-factor authentication, and robust fraud prevention measures are integral components of the platform, ensuring that user accounts and transactions remain safeguarded.

Currency Conversion

Skrill supports a multitude of currencies, allowing users to send and receive money in different denominations. Furthermore, the platform provides currency conversion services at competitive rates, enhancing flexibility for users engaged in cross-currency transactions.

Transaction History

Skrill users benefit from a transparent and accessible transaction history feature within their accounts. This tool enables users to monitor and track their financial activities, providing insights into their spending patterns and transaction details.

Overall, Skrill provides a convenient and secure way to manage your money online, whether you’re sending money to friends and family, making online purchases, or conducting international transactions.

How to Transfer Money with Skrill

Now, let’s proceed with the part you’ve been waiting for. Transferring money with Skrill is easy! Here’s a simple guide:

- If you don’t have a Skrill account, start by signing up on the Skrill website or through the mobile app. Provide the necessary information and create your account.

- Verify your identity as required by Skrill. This may involve providing some personal information and documents to ensure security.

- To transfer money, you need to have funds in your Skrill account. Add money by linking your bank account, credit/debit card, or other available methods.

- Choose who you want to send money to. You can send funds to another Skrill user, an email address, or make international transfers.

- Enter the amount you want to send and choose the currency. Skrill supports multiple currencies, so you can send money in the desired currency.

- Double-check the transaction details, including the amount and recipient information. Once you’re sure, confirm the transfer.

- Select the payment method you want to use for the transfer. Skrill offers various options, such as bank transfer, credit/debit card, or funds already in your Skrill account.

- Follow the on-screen instructions to complete the transfer. Skrill will notify you once the transaction is successful.

- If you’re sending money to someone who doesn’t have a Skrill account, they’ll receive an email with instructions on how to claim the funds.

- Keep track of your transactions using the Skrill platform. You can view your transfer history and monitor the status of your transfers.

Remember to consider any fees associated with the transfer, and you’re all set to use Skrill for quick and secure money transfers!

Conclusion

In summary, Skrill Money Transfer offers a secure and flexible solution for sending and receiving funds globally. With its user-friendly interface, diverse funding options, and robust security measures, Skrill provides convenience and peace of mind to users.

Whether for domestic or international transfers, Skrill’s competitive rates and transparent fee structure make it a preferred choice for efficient money transactions. Overall, it stands out as a reliable and accessible platform for managing financial transactions with ease. Let’s hear your thoughts in the comment section, and don’t forget to share this post on your socials.

Frequently Asked Questions

How do I sign up for Skrill?

To sign up for Skrill, visit their website or download the mobile app and follow the instructions to create an account. You’ll need to provide some personal information and verify your identity.

What are the fees for using Skrill?

Skrill charges various fees for different services, such as transferring money, currency conversion, and withdrawing funds. You can find detailed information about Skrill’s fees on their website.

How long does it take to transfer money with Skrill?

Transfer times with Skrill can vary depending on factors like the payment method used and the recipient’s location. Typically, transfers within the Skrill network are instant, while bank transfers may take a few business days.

Is Skrill safe to use?

Yes, Skrill is considered safe to use. The platform employs advanced security measures, such as encryption technology and two-factor authentication, to protect users’ accounts and transactions.

Can I use Skrill for international money transfers?

Yes, Skrill allows users to send money internationally to recipients in different countries. You can transfer funds in various currencies and choose from multiple payment methods.

What currencies does Skrill support?

Skrill supports a wide range of currencies, including major ones like USD, EUR, GBP, and others. You can check the full list of supported currencies on Skrill’s website.

How do I contact Skrill customer support?

If you have any questions or need assistance, you can reach Skrill’s customer support team through their website or mobile app. They offer various support options, including live chat, email, and phone support, depending on your region.

Also, Check Out: