Belk Reward Credit Card is offered by Synchrony Bank. It enables members to earn more and also save based on the massive reward offer. Members get up to a 3% discount on eligible purchases at Belk or Belk.com.

This can be a great saving tool for frequent shoppers who spend a lot in the store. If you’re among the category of frequent shoppers, why not take advantage of these card rewards by applying? It is very simple to apply for a card. You can apply for the card if you have at least a fair credit score. Thus, you can do your application in-store or online. This article will give you clues on how to apply online.

Every 1,000 points you get with this card equals something great, so to get more points, you must shop more. It is the best for people who shop regularly. If you’re a regular shopper, you will save more money with this card. Apart from the rewards bonuses that come with it, there are other outstanding benefits you will also enjoy from the card.

Belk Reward Credit Card Benefits

Of course, many awesome benefits come with this card. Below are the rewards and benefits of the card:

- Members get a welcoming reward on eligible purchases

- Cardholders are entitled to get 3% Cashback on purchases at Belk or Belk.com

- Users receive receipt-free returns

- Members enjoy exclusive bonus rewards events

- Offers Cardholders savings day

- Cardholders get early access to promotions and events

- Members receive a 2% discount on purchases at grocery and fuel stations

- Get 1% back on all other purchases

The above are the rewards benefits the card offers to users.

Belk Credit Card Application Status

After applying for a card, you were unable to get a reply. Now, you don’t know if you’re eligible for the card or not. The best thing is to check your application status. To check your application status, call on Synchrony’s customer support phone number. You can get Synchrony Bank support phone numbers from their website.

Belk Credit Card Application

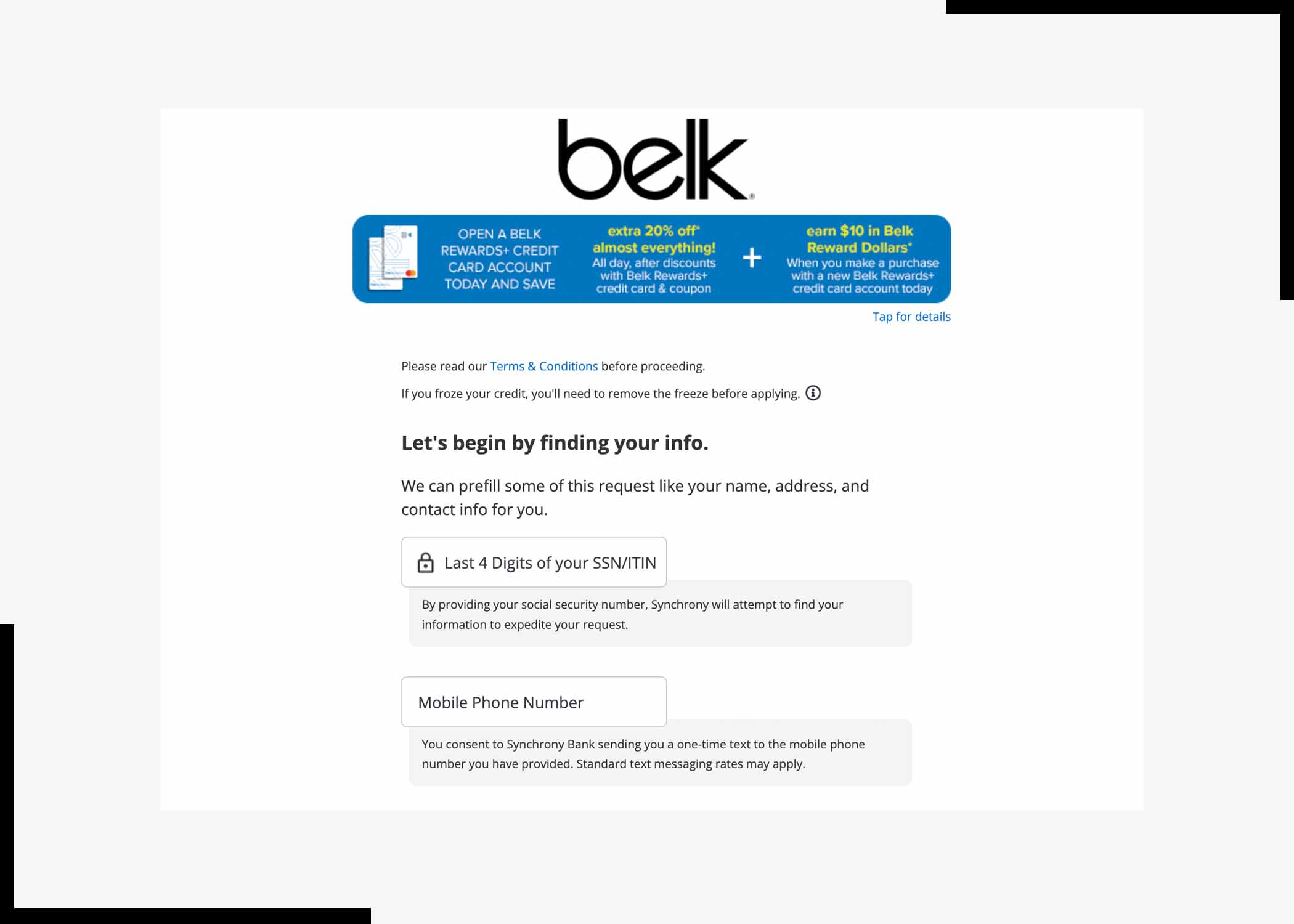

To apply in-store, navigate to the nearest Belk branch and apply. For online applications, follow the directives below.

- Head to https://www.belk.com/belk-rewards-card-program.html

- Move down to the Apply Now tab

- Press on the “Apply Now” button

- Select the “Continue to Belk Credit” link

- Proceed to fill in the form

- Input your personal information, contact, housing details, and your income info.

- Review the information you entered.

- Scroll down to the “Continue” tab and tap on it.

- Follow the lead on the screen to complete the process.

The above steps are steps to apply for a Belk card online.

Belk Credit Card Activation

For you to activate your new card, you need to register for an online account. Follow the directives below to register and activate your new card.

- Navigate to their main page using this link

- Click “I want to Register or Apply.”

- Type in your name, email address, and password

- Hit on the “Create account” tab.

- Follow the guide to activate your new card.

These are procedures to register and activate your Belk card online.

Belk Credit Card Login

Navigate using the steps below to access your account;

- Visit their page at belk.com/belk-credit-card-rewards-benefits.html

- Move up and select the “sign-in” button on the left side of the screen.

- Click on the “Belk Rewards Credit Card” tab from the drop-down menu

- Click on the “Continue with Belk Credit” tab

- Type in your correct User ID and password

- Tap on the “secure login” tab.

The above are procedures to access your account. If you forgot your password, click on the “reset password” button, then key in your User ID and Zip Code. Then, proceed with the guide on the screen.

List of Belk Credit Card Payment Methods

Here are several methods of paying your bills;

For Online payment

- Register for their online service. Go to belkcredit.com

- Locate the registration button and proceed.

- Login to your account

- Go ahead and make your payment

Telephone Payment

To make bill payments via the phone, dial their customer care phone number on the website to pay your bills.

Payment via Mail

Cardholders can forward their payment to Synchrony Bank’s Belk card mail address.

Payment via Store

Want to pay via the store? Well, find the nearest store with the “online locator”. Then, proceed to make your payment.

Conclusion

The Belk Reward Credit Card offers a straightforward and tailored approach to shopping rewards for loyal customers. With its exclusive discounts, special financing options, and the potential for elevated status in the Belk Rewards program, the card presents a compelling proposition for individuals who frequently shop at Belk stores.

While its benefits are primarily centred around Belk-related purchases, the card’s simplicity and targeted perks make it a valuable choice for those looking to maximize savings within the Belk retail ecosystem. If there’s something you feel we have missed out on, kindly use the comment section to let us know.

Frequently Asked Questions

What Credit Score do I Need to get a Belk Mastercard?

For you to get approved for a Belk Credit Card, you need at least a fair credit score (FICO score 650+). To Apply, you have to head to your local Belk store location or use the required link to apply online.

How do I Pay my Belk Account?

You can call Belk customer service to reach the automated system. Or enter your Belk Credit Card number. Then, follow the system prompts to finish your payment.

What Credit Company Does Belk Use?

It is very good you know the company that Belk uses. Belk credit company uses Synchrony Bank. Belk has credit store cards that are issued by Synchrony Bank.

Does Belk do a Hard Credit Check?

The truth is yes; the Belk store card does a hard pull when you apply for it. This might have a Short-term negative effect on your credit score. Unfortunately, there is no way to check if you pre-qualify, but your approval odds are okay, even with fair credit.

How do I View my Belk Statement Online?

You can easily view your Belk Statement Online. They’re just like the paper Statements you receive every month, only in electronic format for viewing & saving online at Belk’s official website.

What Bank Owns Belk Credit Card?

Belk/Synchrony Bank may show up on your report if you apply for a Belk retail credit card. Synchrony is the bank that issues these reward cards.

What is the Lowest Credit Card Score?

The FICO Score, which is the most widely used scoring model, falls in a range that goes up to 850. The lowest credit score in this range is 300. But the reality is that almost nobody has a score that low.

How Long Does It Take to Get Approved for a Belk Credit Card?

The Belk Credit Card approval decisions are usually issued immediately. However, in rather rare cases, it can take up to 4 weeks to get a decision. Suppose 4 weeks to get a decision.

Also, Check Out: